Peering into the Future of Private Benefits Exchanges

Early on in The Wizard of Oz, Dorothy runs across Professor Marvel, “acclaimed by the crown heads of Europe” as someone who can “read your past, present and future in his crystal.”

Professor Marvel greets Dorothy, saying: “And who might you be? No, no, now don’t tell me.

Let’s see. You’re traveling in disguise. No, that’s not right. You’re—you’re going on a visit. No, I’m wrong. You’re, you’re—running away.”

To which Dorothy responds, in all sincerity, “How did you guess?”

When we consider past predictions about the future of private benefit exchanges (PBEs), we find that experts have struggled as much as Professor Marvel to discern the future. And, in 2018 when we consider the viability of PBEs—especially in light of Washington’s mixed support—well, our “crystal’s gone dark,”— just like the Professor’s.

Still, we can’t help but wonder: what will the future of PBEs be?

First, a Definition

PBEs are defined in a variety of ways, but for our purposes, we are thinking of PBEs as does the Rand Corporation in its 2016 report “Private Health Insurance Exchanges[1]”:

“Typically, businesses using a private exchange will offer employees a credit that can be applied toward the purchase of a health plan. Employees can then access a variety of health plans through an online portal and can chose and enroll in plans that meet their needs. . . . [P]rivate exchanges are run by insurance carriers or consultancies, rather than the states or the federal government. Plans offered on [a] private exchange are regulated as group coverage, and employees shopping on these exchanges are not eligible for the ACA’s tax credits or cost-sharing subsidies.”

Dorothy, Meet Malcolm Gladwell

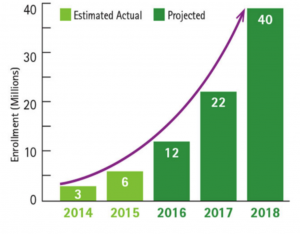

In 2015, Accenture made a bullish prediction: PBE enrollment growth from the then-current level of 6 million to 40 million by 2018.[2] It looks like that growth curve will fall short: in 2016, the actual number of enrollees was only 8 million[3]—making 40 million in 2018 a big stretch.

Why are the numbers off? It’s not because of lack of growth. In November 2016, Employee Benefits Adviser reported that “Since September 2015, the number of employers using exchanges has increased 144%, the number of employees enrolling in benefits through the marketplaces has risen 92% and the number of lives covered by the plans sold on the platforms has jumped 100%.”[4]

Employers’ intentions should have borne out the predicted curve: A 2016 Aon survey found that “15% of organizations are in full replacement now and another 43% are considering it in the next three-to-five years.”[5]

So PBEs aren’t lacking in popularity; it’s just that the growth hasn’t met expectations. It may simply be that Accenture’s projected growth curve was the wrong shape. In his 2000 book, The Tipping Point, Malcolm Gladwell[6] describes an “epidemic curve” that tracks the “contagious spread of a new idea” as a bell curve.

Accenture noted that the “mid-size employer segment of 100 to 2,500 employees is driving initial growth,” which follows Gladwell’s premise. Gladwell writes that Innovators and Early Adopters tend to be smaller companies, more willing to take risks. (Think: “I am Dorothy—the small and meek.” Dorothy undersells herself; she is a leader and a risk taker.)

For the Early Majority—more typically big companies—trying something new is harder because more complex change has to be managed to create success. Because the risk is greater, it is taken on more incrementally and therefore the anticipated benefit also is measured more incrementally. Accenture agrees: “Many large employers have been reluctant to be early adopters of the emerging private health insurance exchange model.” (Think: the Scarecrow, willing to follow Dorothy only after careful debate. And, you know, a song and dance number.)

Lions and Tigers and Bears

What, specifically, makes an employer reluctant to join a PBE? Those 43% of Aon-surveyed organizations who are still considering a PBE could be described as Gladwell’s Late Majority (they want proof) or Laggards (they see no urgency for change) or Cowardly Lions, but that last name would be so judge-y.

Employee Benefit Adviser found seven reasons that employers hesitate to introduce a PBE.[7] I’ll restate these reasons as fears, which of course, is what they really are. These questions explain the stall in Accenture’s projected virality of PBEs; let’s call it the “lions, and tigers and bears, oh my!” syndrome. Fear makes us walk more slowly.

- What if our employees or executives confuse private exchanges with the federal marketplace?

- What if we lose control of our plan design or contribution strategy?

- What if we incur extra costs due to administrative change?

- What if we have to explain different state-mandated benefits to employees across multiple states?

- What if we have to give up a consulting relationship we value or pay more to maintain it?

- What if we aren’t getting objective advice from our PBE sponsor?

- What if our carrier networks are disrupted?

PBEs are answering some of these questions. For example, the Private Exchange Evaluation Collaborative found in a 2016 survey that some 44% of survey participants who had implemented a PBE saved money by doing so.

With that same early experience, some Innovators and Early Adopters are now insisting PBE sponsors introduce more flexibility and customization to their offerings. The next growth area for PBEs may be a combination of continued expansion of the mid-size market and new growth in the larger employer market as the Late Majority becomes satisfied with the answers to its questions.

PBEs Began with a Carrot, Now Here’s the Stick

Dorothy begins her journey with a carrot (she wants to see the Wizard) but that journey is propelled by a stick (the Wicked Witch of the West). As always, the PBE story is not so different. PBEs began by offering choice, glorious choice. But in 2018, so does the stick.

PPACA reporting requirements, the Employer Mandate and the Cadillac Tax—the hassle factor—all may lead to a surge in PBE enrollments as PBEs are well-equipped to satisfy these requirements. Perhaps this will be the urgency the Laggards have been waiting to feel.

Employee Choice

As communicators, we often worry about employees who disdain reading having to sort through oodles of choice. But the reality is that we deal with near limitless shopping choices in our daily lives (thanks, Amazon.com). So, is healthcare choice really so overwhelming?

Yes, yes it is. Health care, while acknowledged by employees to be vital to their employment decision,[8] is not sexy. It’s complicated and a little boring. And this is where Smith sees PBEs not living up to their potential. The templated communications that are bundled into PBE services are often overly long and impenetrable, as well as lacking in any relation to the employer’s story, culture and brand.

Introducing a PBE and educating employees about their options doesn’t have to be a dry, dull business. You do have to pull back the curtain, and transparently show how a PBE works. The 2016 survey from the Private Exchange Evaluation Collaborative also found that employers who had implemented a PBE cited “communications and sufficient time to implement as critical success factors.”

Wherever we can make the PBE shopping experience more like any good online shopping experience—intuitive navigation, more consumer reviews, easier to understand comparison tools, improved decision support tools—we’ll help turn employees into savvy consumers.

When our communications succeed, the choice that could be overwhelming can become what employees value most about their healthcare benefits. And, the shopping experience can drive employee understanding of their benefits. What remains to be seen is whether the PBE also can increase long-term engagement in wellness and consumerism.[9]

It’s All About the Shoes

So PBEs seem here to stay. They are working for employers and employees alike. They may be growing more slowly than expected, but they will keep growing. And the answer to their future growth, like the power of Dorothy’s ruby slippers, is something we’ve had all along—employers just have to learn it for themselves.

Further Reading

Private Exchange Evaluation Collaborative

Employee Benefits Adviser, June 2016:

Employee Benefits Adviser, December 2016:

Sources

[1] http://www.rand.org/pubs/research_reports/RR1109.html

[2] https://www.accenture.com/us-en/insight-private-health-insurance-exchange-annual-enrollment

[3] http://www.forbes.com/sites/brucejapsen/2016/01/20/private-exchange-growth-hits-8m-but-slows-among-large-employers/#645e5b4d6b09

[4] http://www.employeebenefitadviser.com/news/pbe-index-inches-up-as-exchange-market-evolves?tag=00000151-16d0-def7-a1db-97f024de0002

[5] http://www.employeebenefitadviser.com/news/why-private-exchanges-arent-a-stand-alone-strategy?tag=00000151-16d0-def7-a1db-97f024de0002

[6] Gladwell, Malcolm. The Tipping Point: How Little Things Can Make a Big Difference. Boston: Little, Brown, 2000. Print. https://smile.amazon.com/Tipping-Point-Little-Things-Difference/dp/0316346624

[7] http://www.employeebenefitadviser.com/list/7-reasons-employers-are-hesitant-to-adopt-private-exchanges?tag=00000151-16d0-def7-a1db-97f024de0002

[8] http://www.benefitspro.com/2016/01/14/employees-still-value-health-care-benefits

[9] Willis Towers Watson Roundtable Discussion: The Evolution of Private Exchanges for Active Employees (February 2016)